BREAK EVEN ANALYSIS QUIZ

1.

|

Fixed Expenses do not change in

total when

there is a modest change in sales.

|

True

|

False

|

2.

|

An example of a fixed expense would be a 5% sales commission.

|

True

|

False

|

3.

|

Property taxes and rent are often fixed expenses.

|

True

|

False

|

4.

|

Variable expenses change in

total as

volume changes.

|

True

|

False

|

5.

|

An example of a variable expense is an office manager's monthly

salary.

|

True

|

False

|

6.

|

A retailer's cost of goods sold is an example of a variable

expense.

|

True

|

False

|

7.

|

Contribution margin is defined as sales (or revenues) minus

variable expenses.

|

True

|

False

|

8.

|

Break-even point is the point where revenues equal the total of

all expenses including the cost of goods sold.

|

True

|

False

|

9.

|

The break-even point in £ of revenues is equal to the total of the fixed expenses divided

by the contribution margin per unit.

|

True

|

False

|

10.

|

If a company requires a profit of £30,000 (instead of breaking

even), the £30,000 should be combined with the fixed expenses in order to

compute the point at which the company will earn £30,000.

|

True

|

False

|

11.

|

If a company has mixed expenses, the fixed component can be

combined with the company's fixed expenses and the variable component can be

combined with the company's variable expenses.

|

True

|

False

|

12.

|

Decreasing a company's fixed expenses should reduce the

break-even point.

|

True

|

False

|

13.

|

The contribution margin per unit is the selling price per unit

minus the fixed expenses per unit.

|

True

|

False

|

14.

|

Break-even analysis is useful for companies that sell products,

but it is not useful for companies that provide services.

|

True

|

False

|

Use this information to answer questions 15

through 17:

|

||||||||||||||||||||||||||||||

15.

|

What is the company's contribution margin?

|

16.

|

What is the break-even point in units?

|

17.

|

If the company wants to earn a profit of £42,000 instead of

breaking even, what is the number of units the company must sell?

|

Use this information to answer questions 18

through 20:

|

|||||||||||||||||||||||||||

18.

|

What is the company's contribution margin ratio?

|

19.

|

What is the break-even point in £?

|

20.

|

If the company wants to earn a profit of £35,000 instead of

breaking even, what is the amount of sales or revenue £ the company must

achieve?

|

ANSWERS:

1) T

2) F

3) T

4) T

5) F

6) T

7) T

8) T

9) F

10)

T

11)

T

12)

T

13)

F

14)

F

15)

£10

16)

14000

17)

18200

18)

30%

19)

£256,667

20)

£373,333

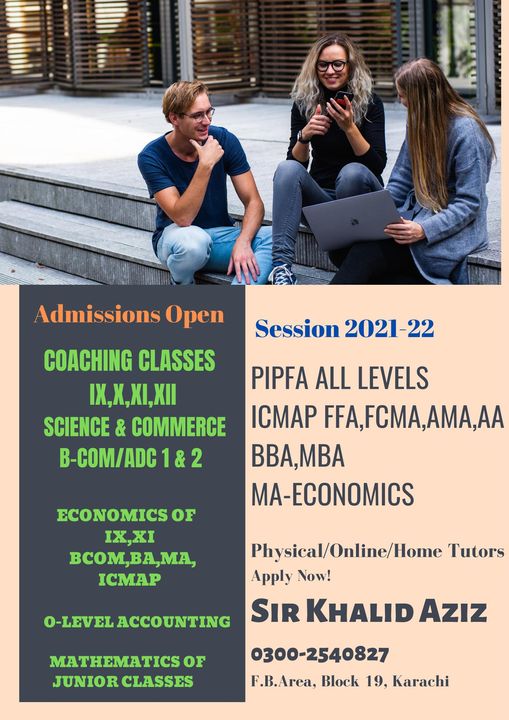

COACHING CLASSES FOR

PROFESSIONAL STUDENTS

ICMAP

semester 1-4

FUNDAMENTALS OF FA

ECONOMICS

FUNDAMENTALS OF COST ACCOUNTING

BUSINESS MATHS & STATISTICS

FINANCIAL ACCOUNTING

MANAGEMENT ACCOUNTING

ICAP

MODULE A,B & D

QUANTITATIVE METHODS

ECONOMICS

FINANCIAL ACCOUNTING I

COST ACCOUNTING

PIPFA (COMPLETE)

FOUNDATION

INTERMEDIATE

FINAL

ICSP

ECONOMICS ENVIRONMENT

INTRODUCTION TO ACCOUNTING

BUSINESS MATHEMATICS & STATISTICS

COMMERCIAL & INDUSTRIAL LAWS

FINANCIAL ACCOUNTING & REPORTING

COACHING CLASSES OF

B.COM, M.COM, BBA,

MBA, MA-ECONOMICS,

O/A LEVELS ETC ARE

ALSO AVAILABLE.

CONTACT:

KHALID AZIZ

0322-3385752

R-1173, ALNOOR

SOCIETY, BLOCK

19,

F.B.AREA, KARACHI.

No comments:

Post a Comment