What is Single Entry System ?

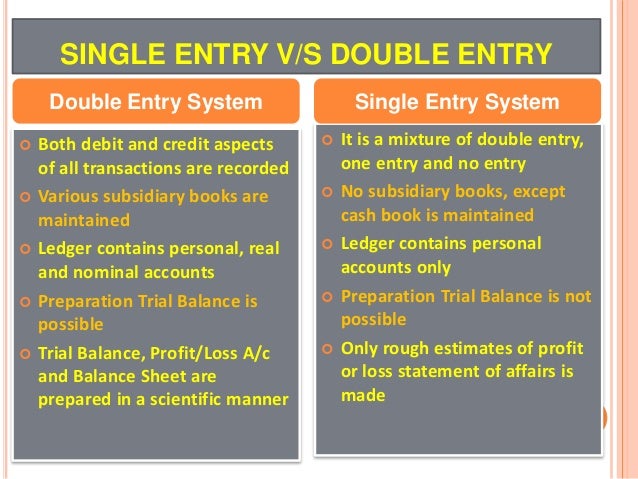

Single entry accounting systems record only one side of every transaction. This happens because they use one entry to record every transaction. Therefore single entry system does not use nominal and real accounts. The emphasis is on cash and accounts receivable.

Single entry accounting system can be described as a system that businesses use to get by rather than something that companies may find desirable.

Small Firms

Single entry system is used by small firms that have just started business. Such firms do not have the resources that are required to put up a full-fledged accounting system in place. Hence they begin with a single entry accounting system. However as and when their business grows most firms are compelled to adopt the double entry system. This is because the single entry system is highly inefficient and can be used only by sole proprietors when the scale of business is very small and the transactions to be undertaken are not very complicated.

Incomplete Records

The biggest problem with single entry bookkeeping system is that of incomplete records. Single entry system records only transactions that the firm is undertaking with external parties. There are numerous transactions within the firm that are of vital importance and need a place in the financial statements. However, the single entry system ignores these needs and gives incomplete information to the management.

No Reconciliation

Single entry accounting system does not have provisions for reconciliation of accounts. This means that the system does not have inbuilt error detection. Therefore, if a clerk is doing the task of making entries in the book, the system may be prone to clerical errors. This could lead to management having insufficient information or no information when they have to make decisions.

Possibility of Fraud

Single entry accounting system is highly prone to frauds and embezzlement. There is only one book of account rather than an elaborate accounting system. Hence, the internal checks are few. In fact they are non-existent. The person making the accounts could single handedly manipulate the books of accounts and misappropriate the resources of the firm.

To counter this problem, Luca Pacioli and other merchants of Venice created the double entry accounting system. This system proved to be very effective and useful and soon became the gold standard for the industry.

Key Differences Between

Statement of Affairs and Balance Sheet

1.

The

basis of preparation of the Statement of Affairs is a partly single entry and

partly double entry system, whereas the basis of preparation of Balance Sheet

is a double entry system.

2.

In the

balance sheet, capital is derived from the ledger accounts. On the contrary, in

the case of the statement of affairs, capital in merely a balancing figure.

3.

A

Balance Sheet is a very important part of the financial statements, but the

Statement of Affairs is not a part of the financial statement.

4.

The

Balance Sheet is accurate as it is prepared after a complete procedure is

followed, but the accuracy of the Statement of Affairs is very less, as it is

ready from incomplete records.

5.

In the

Balance sheet, there are no estimated figures, however, due to insufficient

records, hypothetical figures are taken.

6.

Statement

of Affairs is prepared on either opening or closing date, whereas Balance Sheet

is prepared for a specific date.

7.

There

is no specific format for the Statement of Affairs, whereas Balance Sheet has a

particular format (Revised Schedule VI), on the basis of which it is prepared.

No comments:

Post a Comment