Special Note:

It must be remembered that the loss which is related to branch and which is within the jurisdictions and control of branch, the same should be charged against Branch Profit and Loss Account. Otherwise the same should be charged to General Profit and Loss.

Fixed Assets/Liabilities Account:

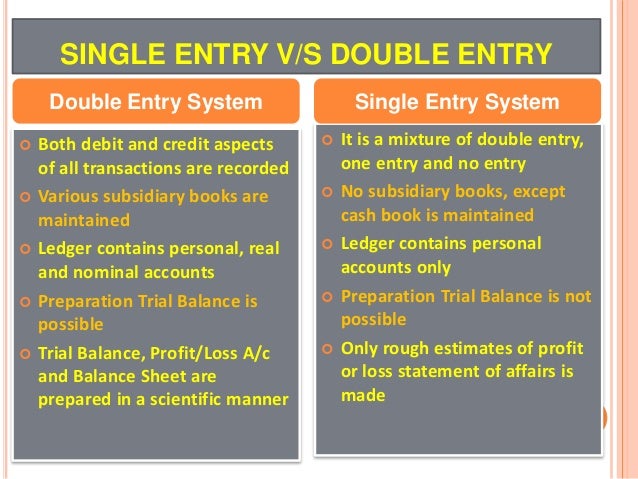

A separate fixed asset account and liabilities account may be maintained by the Head Office as per usual double entry principle, i.e., in case of fixed asset, with the opening balance of fixed assets, purchase of fixed asset will be added and appear in the debit side and depreciation on fixed asset will appear on the credit side to find out the closing balances of fixed assets.

Treatment of some special Items:

Apparent Profit/Loss:

Sometimes Branch Stock account shows an unusual increase or decrease in the value of stock. This is the result of inaccurate prediction of the possible selling prices of the goods invoiced by Head Office. The goods are invoiced by Head Office after charging a certain expected percentage of profit although the goods are sold, in practice, at either more or less than the expected percentage of profit.

As a result, Branch Stock Account reveals either a ‘surplus’ of stock which is called ‘Apparent Profit’ or a ‘deficit’ of Stock which is called ‘Apparent Loss’ — these are not to be treated as ordinary surplus of shortage of stock.

The entries for this purpose are:

In the case of Apparent Loss, the entries will be reversed.

The students should remember that even after adjusting Normal Loss if their is a surplus in Branch Stock Account, the same should be treated as Apparent Profit and not Surplus of Stock.

Loss-in-transit:

Sometimes a part of the goods may be lost during transit, i.e., before the actual receipt of branch.

The entries for this purpose will be:

Pilferage/Shortage/Wastages of Stock or any Abnormal Loss:

The treatment of these items will be similar to Lost-in-transit stated above.

Surplus of Stock:

Sometimes there may be a surplus of stock, i.e., credit side of Branch Stock Account is higher than the debit side showing a surplus of stock.

The entries are:

Illustration 1:

Red & Co. of Mumbai started a business at Bangalore on 1.4.2006 to which goods were sent at 20% above cost. The branch makes both Cash Sales and Credit Sales. Branch expenses are met from branch cash and balance money returned to H.O. The branch does not maintain double entry books of accounts and necessary accounts relating to branch are maintained by H.O.

Following from the details are given for the year ending 31st March 2007.

Draw up the necessary ledger accounts like Branch Debtors Account, Branch Stock Account, Goods Sent to Branch Account, Branch Cash Account, Branch Expenses Account and Branch Adjustment Account for ascertaining gross profit and Branch Profit and Loss Account for ascertaining branch net profit.

Illustration 2:

Y Ltd. opened a new Branch at Vadodara on 1st Jan. 2009 where goods are sent by H.O. at 25% above cost. All expenses of Branch are met from branch cash and the balance remitted to H.O. Branch sells goods both for cash and credit.

From the following particulars, prepare the necessary accounts in the books of H.O. and ascertain the profit or loss made by Branch for the year ended 31st Dec. 2009 assuming that the branch does not maintain double entry books of accounts:

Illustration 3:

Mithu-Mon Ltd. has two branches, one at Kolkata and the other at Chennai Goods are invoiced to branches at cost plus 50%. Branch remits all cash received to the Head Office and all expenses are met by Head Office.

From the following particulars, prepare the necessary accounts, under the Stock-Debtors System, to show the profit earned at the Branches:

Illustration 4:

A Head Office in Patna has two branches at Kolkata and at Chennai. Goods are consigned to them at loaded figures of 10% and 20% on cost, respectively. During the year, invoices to the Branches are Rs. 44,000 and Rs. 60,000, respectively.

Included in the item Rs. 44,000 are invoiced for goods costing Rs. 12,000 invoiced to Kolkata Branch at Rs. 13,200 which should have been invoiced to Chennai Branch. Sales are all for cash, being Kolkata Branch Rs. 22,000 and Chennai Branch Rs. 50,400. It may be assumed that closing stocks are correct.

Prepare the (i) Branch Stock, (ii) Goods Sent to Branch, and (iii) Branch Adjustment Accounts in the books of Head Office.

Sankha Trader Ltd. sends goods to its Gauhati Branch at cost plus 25%. From the following particulars you are required to show the necessary ledger accounts in the Head Office books:

Illustration 6:

Columnar Branch Stock Account (where there are two branches):

Pure Silk Company of Mursidabad has two Branches, one at Kolkata and the other at Delhi. Goods are invoice by the Murshidabad Head Office to its branches at cost plus 50% on Cost Both Cash and Credit Sales are made by the Branches and all cash collected by the Branches is sent to the Head Office and the Branch expenses are met by the Head Office.

The following particulars are supplied by the Branches for the year ended 31st March 2011:

Note:

When Branch Stock Account is prepared under Double Column, there is no necessity of preparing Branch Adjustment Account as Gross Profit can easily be ascertained from Branch Stock Account under Cost Price Column. Students are advised to complete the Invoice Price column at first.

Illustration 7:

Janata Traders, at Salt Lake, has a number of branch shops at different places of Kolkata All accounts are maintained by H.O. Goods are invoiced to branches at cost plus the expected mark up to 33⅓% and the accounting system is designed in such a manner which gives the H.O. as much control as possible over the branch stocks.

At Park Circus Branch at 1st Jan. 2009, goods costing Rs. 4,800 were in stock, apart of those goods costing Rs. 600 had been reduced in selling price to Rs. 675 and the balance of Debtors at the same time was Rs. 2,500.

The following particulars relating to Park Circus Branch at 31st Dec. 2009 were:

Illustration 8:

D Ltd with their Head Office at Delhi, invoiced goods to its Branch at Ghaziabad at 20% less than the list price which is cost plus 100% with instruction that cash sales were to be made at invoice price and credit sales at catalogue price (i.e., list price).

From the following particulars available from the Branch, prepare Branch Stock Account, Branch Adjustment Account, Branch Profit and Loss Account and Branch Debtors Account for the year ending 31st Dec. 2008:

Illustration 9:

Multi-chained Stores Ltd., Delhi, has its branches at Luck-now and Chennai. It charges goods to its Branches at cost plus 25%.

Following information is available of the transactions of the Luck-now Branch for the year ended on 31st March 2012:

Goods worth Rs. 15,000 (included above) sent by Luck-now Branch to Chennai Branch was in- transit on 31.3.2012.

Show the following accounts in the books of Multi-chained Stores Ltd.:

(a) Luck-now Branch Stock Account;

(b) Luck-now Branch Debtors Account;

(c) Luck-now Branch Adjustment Account;

(d) Luck-now Branch Profit and Loss Account and;

(e) Stock Reserve Account;

(f) Stock Lost by Fire Account; and

(g) Petty Cash Account.